|

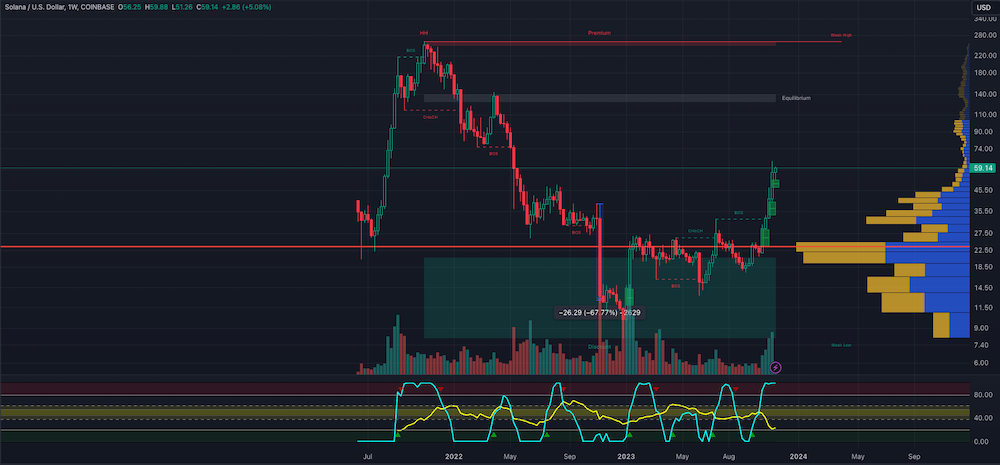

I am a big fan of Solana. As an asset, it has been very good to me both speculatively and long-term. As you all know, I am a big fan of NFTs. All NFTs of mine sold were through Solana. You may now understand my love for this asset. I confess recent price moves were more than welcome. Nevertheless, the cost of minting an NFT has risen - something unwelcome! Those using ETH certainly understand this sentiment! Solana has been a tear in recent weeks and went on to surpass USDC. It is now the sixth-largest cryptocurrency by market capitalisation. Over the last thirty days, we have seen a price rise of 162.1%. In addition, we have seen a 36% price rise over seven days. Two days ago, the price dropped to $51.54 but has since recovered to $59.15 at the time of writing. So, are we to expect another storm? Let us look at the charts. The daily chart shows a strong trend to the upside. There is also a price equilibrium between $39 and $42. This price range may act as support if there is any sudden fall in price. The volume profile indicates that with good momentum, there is nothing to stop the price from rising above the $63 range. One can easily question this as market energy is low at 25. I suppose we will have to wait and see what price action does. The weekly chart paints a similar picture, but being the higher timeframe with even lower energy at 22 causes some concern. We may yet see the price fall, but as mentioned, the $39 - $42 range may act as support. We all know that even when the charts say one thing, people's emotions can create an unrealistic asset price. Solana is in danger of just that. The question remains - is there another storm on the way? Maybe. No one knows. Conditions for another run upwards are present. As for if and when it will happen, your guess is as good as mine.

0 Comments

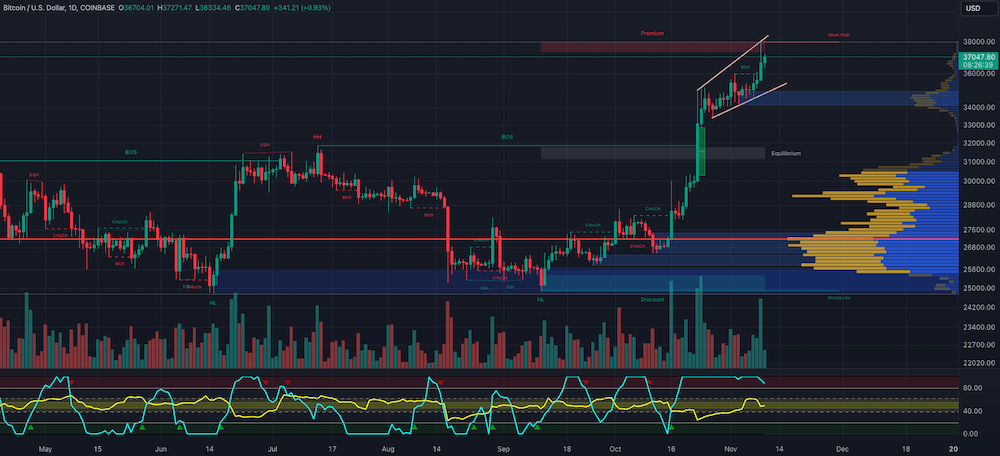

For full disclosure purposes, I am long on BTC! Ok, people, I have said it, so now you know. I am sure that most of you are watching the BTC price closely. For some, they found themselves on the outside looking in. I give no financial advice; I am not qualified. For those looking, wait till there is a retracement. We do, however, have a problem with this thesis. The BTC chart shows an ascending broadening wedge. An ascending broadening wedge, according to excellenceassured.com, is as follows: Price makes a low and rises. We then track price as it rises away from the low. We are looking for higher highs and higher lows in a tight range. The ascending says just one thing - the price will continue in its current direction, up. There is also an area of institutional selling, which doubles as a weak high. I have said in an earlier post that I expect the BTC price to hit $38k. It did so by hitting $37999! One expects Bitcoin to achieve that price point. At the mo, BTC is just over $37k, and the Choppiness Index shows there is still enough market energy to move the market upwards. Perhaps when it hits that point, a retracement will occur. No one can tell. Let me add this final point: energy on the weekly chart shows a decline. The Choppiness Index reads a value of just over 35. Market energy at this level might be just enough to ensure the $38k price point. As always, we are making educated guesses. Those late to the party pray for a retracement, and as to when it will arrive, your guess is as good as mine.

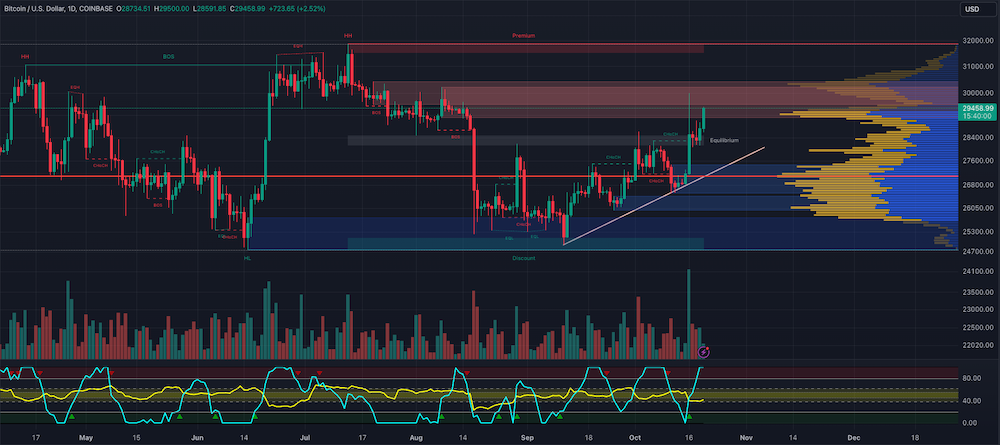

I wrote a blog yesterday with the Directional Movement Index (DMI) as the focal point. I did not publish it for all to see. Reasonable it may be, convincing it was not! I returned to using the indicators I always use - Laguerre RSI, Choppinex Index and the Volume Profile. So, here is my short and sweet analysis. Let us start with the weekly. The current BTC price is almost at the point of equilibrium. What this means is that there is an equal amount of buyers and sellers. Here, we have price levels of between $35.5k and $38k. The BTC price has tested the $35k level several times and will eventually break through. Should the breakthrough come, we will have BTC rising almost unimpeded to $38k. At this level, the Laguerre RSI and Choppiness Index have the strength to ensure this. Who knows, maybe the price will hit the $47k mark as long as there is strength in market energy (choppiness index). We now turn our attention to the lower time frame of one day. Here, we see strength in both the Laguerre and the Choppiness. The Choppiness is reconstituting strength, which will help further market momentum. Some analysts have posited a fall in BTC price levels. One may believe this to happen sooner than later because BTC is at an institutional selling price level, as you can see on the charts. At worst, I think BTC may fall to around $30k. Only something dramatic can bring it down to $25k levels. There will be retracement at some levels, but not the falls analysts are expecting. The uncertainty in the markets at the moment is causing all to be confused with the overall direction. Technical analysts among us will continue to look to the charts for answers. Others will lean on fundamental analysis. Some may even look to the stars for answers. Nevertheless, whatever you may have found or guided you, your guess is as good as mine.

Before discussing today's topic, let me refer you to a post I put out on the 9th of October titled, "BTC: Is There Too Much Excitement?" I stated that if BTC hit the $30500 price (a move of 8%), we could be on for a bull run. Ladies and gentlemen, we have hit that price level. There is the question of what's next. Let's have a look at the charts. On the daily chart, we see that the Laguerre RSI indicating BTC is overbought. There is also the fact that the flattening of the Laguerre RSI shows a continuous price rise. The Choppiness Index shows a drop in energy to 38, which means the price may begin to fall. I think the Choppiness Index will begin to consolidate for prices to continue to rise. I also suspect that the price will hit $32k before seeing a retracement. The reason for this is that we have a weak high at this level. On the weekly, the signs are more encouraging. The Laguerre RSI shows an upward momentum and is not in the overbought region. There is also strength in the Choppiness Index - meaning there is plenty of market energy. Judging by the volume profile, we expect BTC to hit $35k. Some analysts are now warning of the price action in the S&P 500. They posit two things. One, the S&P 500 is now below its 21-weekly moving average. Two, the S&P 500 price is also below the trend line. They believe that we must be concerned with this development. It means that these two signs indicate a fall in the overall market and the price of BTC. It will be interesting to see what happens as time goes on. As analysts, we can only posit based on experience, but no one can tell you what will happen. When we forecast, we hope it is in the right direction. Other than that, your guess is as good as mine.

You may have taken your eyes off the ball when Bitcoin blasted its way to US$30k. In other words, you were busy with other matters. I was one of such people. On the evening of Monday the 16th, I got my first chance that day to look at the charts. To my surprise, I see the BTC price at US30k. I did wonder what brought this about. As I looked into it, reports surfaced that the approval of a BTC ETF (Exchange Traded Fund) is imminent. These reports were false and rumours. In the world of crypto, a day is a very long time. These rumours now have some validity. The SEC's (US Securities and Exchange Commission) recent losses in court have contributed to the excitement that there will be a BTC ETF before the end of the year. Institutional players, including BlackRock and Cathie Wood's ARK, are clamouring for this. It seems the tide has turned. A look at the charts tells us a lot. First, a new series of higher highs and higher lows indicates increased activity in the market. Second, the price broke through a confluence of institutional selling at price points between $29k and $30.2k. Many analysts believe $35k is possible. Some have gone as far as $40k. Finally, the series of higher highs and higher lows emanate from areas of institutional buying. The Laguerre RSI at 100 indicates that BTC is overbought. While the Choppiness Index has barely enough energy for a price push. These indicators tell us that prices may fall. Nevertheless, with the rumours swirling around, investors may be too enthusiastic to have a correction. So, do rumours conquer all? Sometimes, I guess. And as for the optimistic bets of $40k BTC, your guess is as good as mine.

I am not for making predictions, but the Bitcoin predictions are fun to watch and see who is correct. Perhaps we should bear in mind something said by Peter Drucker:

Trying to predict the future is like trying to drive down a country road at night with no lights while looking out the back window.

We have seen some crazy predictions made about Bitcoin. Some have spoken of over a million dollars in price. Nevertheless, several subscribers asked me to predict the BTC price at the end of the year. I was reluctant but said $70k would be as far as it goes. (Please see a copy of the newsletter sent out in January 2021; the prediction is in yellow highlight). We all know that the highest price for BTC this year was $69k. Some will argue that there are still a few days left in the year, but I don't think we will see anything remotely close to $69k.

Newsletters from January 2021

I believe that 2022 is going to be a year of development. We all know the Metaverse will grow. NFTs will continue to surge, and of course, DeFi will continue to blossom. The interest is in the price of Bitcoin. We at Nosa Capital can give no financial advice, but we posit that the price will be $110k. Lord only knows what some pundits will predict for next year. One can only suppose things are going to get interesting.

I think it best to conclude with a quote from Damien Rice: I have an abundance of enthusiasm; however, it would be foolish to think I can predict a future that doesn't exist.

We all know the crypto crowd has boatloads of enthusiasm but not necessarily the discipline to curb that enthusiasm. Let us all proceed with caution. And as to what the final price may be, your guess is as good as mine.

We all know it people, NFTs are the hot stuff of crypto in recent months. This is bound to continue Here are just some of the stories you can read in our NFT Space Flipboard magazine:

A more enjoyable option would be for you to read the magazine on your iPad using the Flipboard app. If you do not have the Flipboard app, download in the app store, install, and enter the "NFT Space". This magazine is curated by Olusegun Oyekanmi

You can see other NFTs at OpenSea and ShowTime: Opensea: https://nosax.me/2WuYYmI ShowTime: https://nosax.me/3x0qiqV It has been a while since our last mention of stories you may have missed. A lot has happened since then, most of it quite exciting. Considering the amount of activity in the last few weeks , you could be forgiven for missing a story or two.

A more enjoyable option would be for you to read the magazine on your iPad using the Flipboard app. If you do not have the Flipboard app, download in the app store, install, and enter the "Blockchainology". This magazine is curated by Olusegun Oyekanmi

A few days ago, the price of Bitcoin suddenly dropped. Why has this happened? We don't know. You will hear all sorts of reasons from people trying to sound intelligent and in the know. Don't be deceived. Those involved in derivatives, on the other hand, have felt the price drop. Those who have taken a long position(believe that the price will rise) in BTC have found themselves on the losing end. This audio blog is, to some extent, a rant. Enjoy!

Here is the first of many alerts to come to you concerning NFTs. If you have anything to do with the crypto industry, you will have heard of NFTs. NFTs (Non-Fungible Tokens) are crypto-assets used to authenticate ownership of digital assets such as artworks, music, books, collectibles, virtual real estate, virtual pets, etc. The key here is the authentication part. Now that there is digital asset authentication, there will be no ownership disputes. Here are just a few of the stories you can read in our magazine:

A more enjoyable option would be for you to read the magazine on your iPad using the Flipboard app. If you do not have the Flipboard app, download in the app store, install, and enter the "NFT Space". This magazine is curated by Olusegun Oyekanmi As mentioned in the audio section, here are the NFTs we've put together on OpenSea:

https://nosax.me/2WuYYmI |

Swap your cryptos here:

Nosa Capital

Nosa Capital concentrates its' expertise in Strategy, Business Development, Project Management, Project Finance, Trending, and now cryptocurrencies Archives

November 2023

Categories

All

|

Photos from QuoteInspector, wuestenigel, Hektorej, SimpleFX, verchmarco, barbourians, Bestpicko, Noam A., verchmarco, verchmarco, wuestenigel, wuestenigel (CC BY 2.0), Casinolobby.dk, mr.ddenisov, focusonmore.com (CC BY 2.0), PerfectHue, b_d_solis, davidstewartgets, wuestenigel, afiler, wuestenigel, verchmarco, SimpleFX, nodstrum, wuestenigel, verchmarco (CC BY 2.0), wuestenigel, sirqitous, TheAlieness GiselaGiardino²³, QuoteInspector, wuestenigel, marcoverch, Jorge Franganillo, verchmarco, wuestenigel, wuestenigel, wuestenigel, wuestenigel, Jorge Franganillo, wuestenigel, TLC-kios, SimpleFX, SimpleFX, wuestenigel, wuestenigel, wuestenigel, wuestenigel, verchmarco, wuestenigel, Infosec Images, ttmarketing, Toolstotal, SimpleFX, wuestenigel, marcoverch, wuestenigel, focusonmore.com, Cryptodost, zcopley, btckeychain, Crypto360, QuoteInspector, wuestenigel, davidstewartgets, trendingtopics, Raisin - Finance Stock Images, wuestenigel, stockcatalog, verchmarco, focusonmore.com, wuestenigel, TwinPeaks99, orgalpari, marcoverch, orgalpari, arne-mueseler.com, orgalpari, Bestpicko, Jim Makos, wuestenigel, jane.boyko, Infosec Images, verchmarco, SimpleFX, stockcatalog, Bestpicko, mikemacmarketing, wuestenigel

RSS Feed

RSS Feed