|

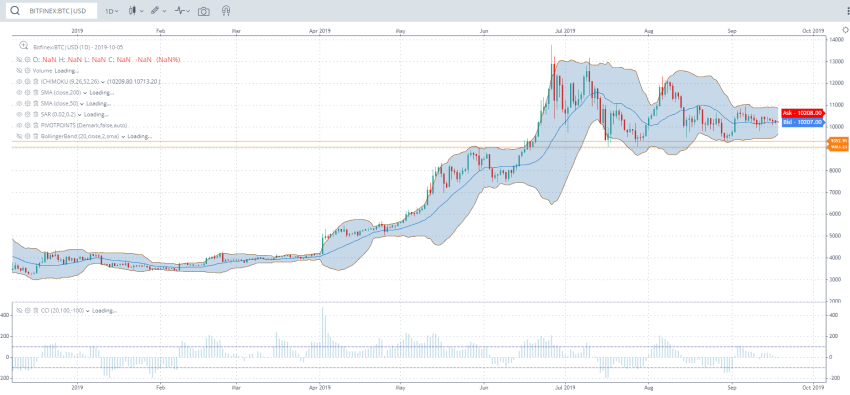

The cryptocurrency market is probably one of the most confusing and frustrating markets ever in existence. This has been further exacerbated by the presence of social media. Social media is not necessarily a bad thing. We now have sentimental analysis in full swing due to social media. One example is Twitter. This platform can inform an investor/speculator information as to what to expect from a particular asset. This very same media platform is also full of rumours and of course false information. This is why I would rather study the charts and ignore the chatter. Social chatter on Bitcoin is particularly infuriating. Case in point, Bitcoin is dead articles. Getting back to Bitcoin, we all have observed that it has been in a consolidation pattern. Price volatility has not been too bad. I am sure those using Bollinger bands can bear witness to that. Looking at the BTC charts, we realise that price has tested support several times over the last few months. That support is at $9352 level. Remember the more times price tests a key level, the more likely it will be broken. As seen on the chart, if Bitcoin tests this key level, it will be the fourth time and may well breakthrough. If this level is broken, and price falls to $9083, expect the price to fall to the $8000 level. You must remember that you are not alone in observing price movements, others are seeing the same patterns. Traders in long positions may well feel that the BTC price may well drop below support. The more insecure they feel, the more they are likely to sell their positions. We must not fail to mention those on the sidelines, in other words, those not in the market but observing. For them, an opportunity to sell into the market may have presented itself. They are likely to sell short. This will put even more selling pressure on the price of Bitcoin. Having said that, nothing is stopping the price hitting $12000. We cannot underestimate that possibility. As I have often joked in the past, all it takes is Vitalik Buterin changing the colour of his underwear and the price goes up. I have admitted that things have since changed from such days. The crypto market is still fickle and could change suddenly with no warning. And as to where the price is heading, your guess is as good as mine.

1 Comment

A short while ago I dropped a line about seeing how the price of Bitcoin moved closer to the 200-weekly moving average (WMA) as being an indicator of what might happen to its’ (Bitcoin) price. The significant detail to notice here is whether the Bitcoin price crosses the 200 WMA and if or when it does what to anticipate. Looking closely at the Bitcoin weekly chart, we can determine that on several occasions the price had touched the 200 WMA. As of this day, the 200 WMA is at $3276. 8. The price of Bitcoin at the time of writing was $3707. Although the price of Bitcoin has not fallen to the 200 WMA price, it is quite close considering the cryptocurrency’s volatility. With a difference of just under $500, we all hold our collective breaths to see if this happens. Chart courtesy of investing.com We must all recall one thing, statistically, if the price goes down and closes below the 200 WMA, then the odds of a downturn increase substantially. As is known, this is not strictly true when taking the markets (any market) into consideration. The cause is simple, markets (any market) do what they want, regardless of what we desire. Even if the price of Bitcoin hits the 200 WMA line, it may bounce off to a higher price, and maybe even be the start of a new bull market. All we can do is to wait and see, but then again, your guess is as good as mine.

By now cryptonistas will have noticed that the dust seems to have settled on the Bytecoin saga (if you can call it that). As I write, Bytecoin (BCN) is still ranked in the top 40 on Coinmarketcap and priced at $0.00137598 on the Poloniex exchange. This is up from a low of $0.00126080. So, what is Bytecoin? Bytecoin is a decentralized cryptocurrency based on the cryptonote technology designed to protect a user’s privacy with untraceable payments. In the beginning, all seemed well until it was discovered that there had been a premine of the coins – 82% to be exact! Some have disputed this claim. There is a way to sort that out – look at the blockchain. Enough said! Well, not really. I may remind you that Satoshi Nakamoto did mine for Bitcoin (some say premine) and then disappeared. One could argue that this was when he was demonstrating proof of concept. “Maybe” the Bytecoin team were doing the same (really, at 82%!). Perhaps the biggest problem for Bytecoin is that the people behind the coin are not really known. This “shady” beginning has not helped. The irony of it all is that Monero is a fork of Bytecoin and has gone on to be very respectable within the crypto community. One day in October we woke to find that the price of Bytecoin dropped dramatically. It turns out that the most powerful crypto exchange – Binance – delisted Bytecoin. A second exchange – OKEx – soon followed. Binance gave its reasons for the delisting, which include commitment of team to project, level of public communication and activity, and evidence of unethical/fraudulent conduct. OKEx main reason for delisting was that there was a critical technical issue left unhandled. As to be expected, the price fell. As we have seen, Bytecoin is down but not out. It remains in the top 40 and its price has risen. This is a far cry from the euphoria of its Binance listing and the partnering with Lydian that used Bytecoin for its ICO. Some cryptonistas have seen a buying opportunity while others think it is the end of the road. If there is one thing I have learned about the crypto market is to never write any cryptocurrency off. All it takes is a smidgen of good news and the price heads off to Jupiter. No one really knows where things will end. And as for my thoughts on the matter, I wondered why all fuss on a coin with little or no importance than it might have had. In other words, much ado about nothing. I am surprised it is still in the top 40 of cryptocurrencies. As for where it will all end, your guess is as good as mine.) Disclosure: I do own some Bytecoin from mining when I first came across Minergate. I also obtained some from the free give away sites. I make no suggestions of purchase to anyone, do so at your own risk.

Before continuing, I just want to state that what you are about to read is what I wrote on Saturday. The only thing I have changed is the diagram, which captures the price of Bitcoin a few minutes ago. I see no reason to change my view. Investors and traders have not seen a time more confusing and volatile than in the last two weeks. I have often joked that all it takes to move cryptocurrencies is for Vitalik Buterin to say he has changed his coffee brand and prices will fall. We all know that the ETF rejection has caused the latest price movements. Having said that, where is the Bitcoin price going? In my blog piece, “Bitcoin – Bearish Sentiment, Bullish Feelings”, I said we need to watch the clouds to see, which direction the price of Bitcoin takes; it has finally taken a trend direction – a bearish one. There are two key variables to saying this. First, the candles have come out of the cloud at the bottom. This means that the trend is in a downward direction. Second, the tenkan-sen (the blue line) has crossed the kijun-sen (black line) in the downward direction. A third point can be made by looking at the cloud itself. Notice that the red line also called Senkou span B is above the green line – Senkou span A – then the trend is bearish. Ichimoku purists may insist that both the kijun and tenkan-sen must also be under the cloud to confirm the bearish trend. Nevertheless, the more aggressive traders may believe it is worth taking the risk despite not all variables aligning. We must also remember that this is the weekend and as such many institutions as well as individuals are bound to use trading bots. Just as I concluded in another of my previous blogs, a combination of trading bots and animal spirits bring about the level of uncertainty and volatility we are witnessing. Expert or not, we do not really what the bitcoin price will do any minute now. But just in case you are wondering, your guess is as good as mine.

Over the last 3 days or so, we have witnessed a volatile Bitcoin price, which seems even more confusing. The price has ranged between $7300 to $8300. This has also added to the confusion as to whether we are in a bull or bear market. Pundits, as you can expect, are already discussing this even though many have no convincing story. The charts, on the other hand, paint a different story. By now you all know I love the Ichimoku Cloud for my analysis (you’ve heard it adnauseum, apologies to all). Looking at the graph below shows that the price candles are solidly within the cloud. When price candles are within the cloud, traders neither buy nor sell. It is considered better to wait for the candles to come out of the cloud before buying or selling. Of course, as a trader, you will consider other factors such as if the asset is overbought or oversold. In addition, the Kijun sen is telling us not to trade by flattening out as can be seen on the graph. Some pundits are saying that as long as the price of Bitcoin remains above $6000, we are still in a bull market. I have long stopped arguing and stuck to the charts. Bearish sentiment is all around us even the altcoins have taken massive drops, Nano, Waves, and Neo come to mind. Eventually, the candles will come out of the cloud in a certain direction, which will confirm the market sentiment. So, in which direction do you think sentiment will head, your guess is as good as mine.

Ahoy there. Once again we bring you crypto stories you may have missed from the past few days or even weeks. Don't forget to check out our Flipboard magazine for more.

The Best Tools To Automate Your Cryptocurrency Trading

Bitcoin vs Altcoins: Which Cryptocurrency Is the Most Usable as Money? Augur joins the ranks of ERC-20 tokens which have launched their own platform

Lessons Learned from the Recent Bancor Incident

Opera becomes the first major browser to debut a built-in cryptocurrency wallet

Bitcoin Will Die At $43 As Mining Costs Far Exceed Profitability

How Distributed Ledger Technologies are set to disrupt the world’s monetary system

The best place to read these stories and more is to head off to our Flipboard magazine (online):

The Blockchain Is The Future (Click Read Magazine to start Reading)

A much better option would be for you to read the magazine on your iPad using the Flipboard app. If you do not have the Flipboard app, download in the app store, install, and enter the "Blockchain Is The Future". This magazine is curated by Olusegun Oyekanmi

The recent massive price drop in bitcoin on Sunday was nothing short of dramatic. Perhaps what’s surprising and at the same time not is the sudden drop from a sideways-uninspiring market to a bloodbath. Estimates put it at about $42 billion in losses. Nothing unusual in the world of crypto but nonetheless painful. I even tweeted out asking if anyone could explain what was going on. A friend reached out explaining that there had been a hack of an exchange – Coinrail - in South Korea. We all know how fickle the crypto market can be. All it takes is an announcement that Vitalik Buterin has changed his brand of coffee and the market panics. This, however, was unprecedented. I wondered what was next. If there is anyone out there with knowledge of what really happened, please do tell. There have also been reports of manipulation. As a friend suggested, look at the charts and convince me otherwise. I had no answer to his suggestion. Things were way too exciting. So, where next for the bitcoin price? Your guess is as good as mine.

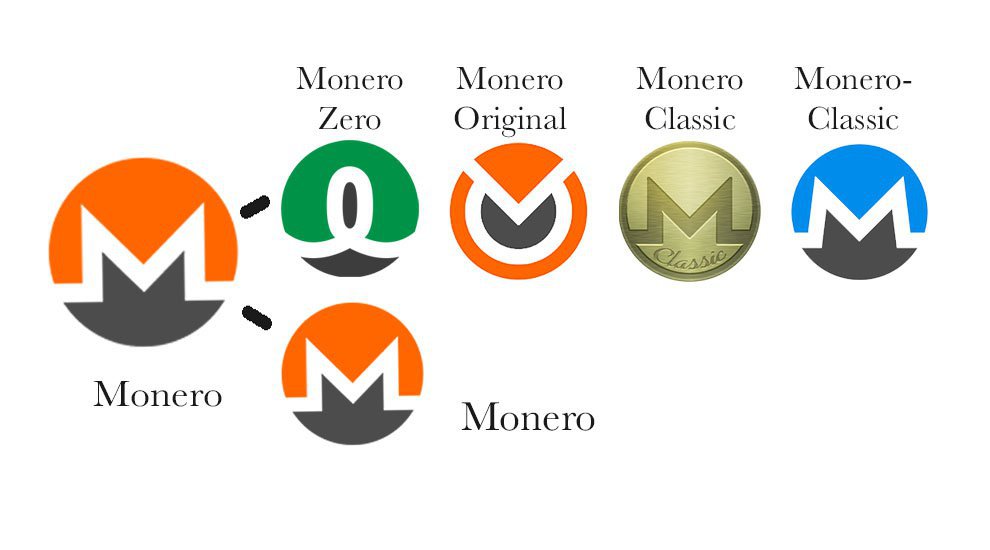

Monero has been in the news recently especially on matters of its’ hard fork, which took place on April 6th. For those that don’t know, Monero is a peer-to-peer decentralized digital currency that offers a high level of anonymity for users and their transactions. Because of these characteristics and more, Monero was beloved by many. Hard forks in Monero were not new as one was done every six months as part of the upgrade process. Mining in Monroe was done with CPU (Central Processing Unit) and GPUs (Graphical Processing Unit), which was ASIC (Application Specific Integrated Circuit) resistant. The lack of ASIC mining has led hardware manufacturers such as Bitmain to develop CryptoNight ASIC miners. As part of the hard fork, Monero changed the CryptoNight Proof of Work (PoW) hashing algorithm. This change is also backward-incompatible, thus rendering all ASIC mining equipment useless. The traditional CPU and GPU mining brought decentralization. ASIC mining, on the other hand, could potentially take away a lot that decentralization, hence, the resistance. Another reason for the resistance is that ASIC could launch a denial-of-service (DoS) attacks on non-ASIC miners and non-mining nodes on the network. So, what has happened after the hard fork? It resulted in four coins being created with all sharing the pre-hard fork original blockchain. Here is a very brief description of all four coins: Monero Classic (XMC) The first of the hard forks courtesy of a Singapore-based group. This group is made up of reputable miners and developers. They believe that ASIC development is healthy and should be market driven. This group also believes that changing the PoW leads to more centralization. See the table below for a quick comparison of Monero and Monero Classic. (Table courtesy of Monero.org)

Monero-Classic (XMC) Ah yes, this is not a double take. These are different coins with this one having a hyphen. This coin is handled by a Chinese rep called PZ. PZ believes that the emergence of technologies such as ASIC is normal in the course of cryptocurrencies. It (the coin) is promoted by AntPool a mining pool owned by Bitmain. Bitmain has, however, denied any connection. Use table above for comparison. Monero 0 (XMZ) Called Monero Zero, its’ representatives call themselves “Proof of Work Maximalists” and stated that they are “concerned users”. This group also strongly disagrees with the strategy of continuously hard forking of Monero. They believe this is not stable nor sane as a strategy. In addition, the group concludes that this is not a fork, but the original Monero. They also believe that Bitmain is trying to destroy Monero. See table below for quick comparison (Table courtesy Monero.org).

Monero Original (XMO) Not much is known about this incarnation of Monero. This team has released statements to the effect that Monero is about freedom of choice, diversity and for the fans to have the possibility of remaining on the original chain. HitBTC has announced that it would make XMO balances available to all XMR holders. HitBTC may offer XMO exchange services in the future. See table below for quick comparison (Table courtesy Monero.org).

One more thing, on April 30th, Monero V will be created from the scheduled hard fork. The table below shows the technical comparison. (Table courtesy Monero.org)

Now that you know which Monero is which, which one are you?

Is bitcoin the blueprint for a bank-less currency, or the biggest pyramid scheme ever? What if we could create money ourselves, without the need for banks? Money that can’t be forged, that will appreciate rather than depreciate, and that can be used worldwide without transaction costs. It exists, and some people consider it to be the digital version of gold: bitcoin. Is this really a perfect bankless alternative for the failing finance sector, or are we simply shifting power from the current elite to a new one? When the financial world collapsed in 2008, a mysterious genius under the pseudonym Satoshi Nakamoto presented the architecture for the perfect, bankless currency. Bitcoins can’t be forged, and can be transferred worldwide with one click of a button, without transaction costs. Up till today, nobody knows who Nakamoto is, but his invention of the first decentralized cryptocurrency became world-famous within a couple of years. Bitcoin was initially dismissed as unsafe and only interesting to criminals. But in fits and starts, the exchange rate kept going up, and more and more banks and governments are realizing that bitcoin is an invention they can’t ignore. |

Swap your cryptos here:

Nosa Capital

Nosa Capital concentrates its' expertise in Strategy, Business Development, Project Management, Project Finance, Trending, and now cryptocurrencies Archives

November 2023

Categories

All

|

Photos from QuoteInspector, wuestenigel, Hektorej, SimpleFX, verchmarco, barbourians, Bestpicko, Noam A., verchmarco, verchmarco, wuestenigel, wuestenigel (CC BY 2.0), Casinolobby.dk, mr.ddenisov, focusonmore.com (CC BY 2.0), PerfectHue, b_d_solis, davidstewartgets, wuestenigel, afiler, wuestenigel, verchmarco, SimpleFX, nodstrum, wuestenigel, verchmarco (CC BY 2.0), wuestenigel, sirqitous, TheAlieness GiselaGiardino²³, QuoteInspector, wuestenigel, marcoverch, Jorge Franganillo, verchmarco, wuestenigel, wuestenigel, wuestenigel, wuestenigel, Jorge Franganillo, wuestenigel, TLC-kios, SimpleFX, SimpleFX, wuestenigel, wuestenigel, wuestenigel, wuestenigel, verchmarco, wuestenigel, Infosec Images, ttmarketing, Toolstotal, SimpleFX, wuestenigel, marcoverch, wuestenigel, focusonmore.com, Cryptodost, zcopley, btckeychain, Crypto360, QuoteInspector, wuestenigel, davidstewartgets, trendingtopics, Raisin - Finance Stock Images, wuestenigel, stockcatalog, verchmarco, focusonmore.com, wuestenigel, TwinPeaks99, orgalpari, marcoverch, orgalpari, arne-mueseler.com, orgalpari, Bestpicko, Jim Makos, wuestenigel, jane.boyko, Infosec Images, verchmarco, SimpleFX, stockcatalog, Bestpicko, mikemacmarketing, wuestenigel

RSS Feed

RSS Feed