|

I apologise for not posting anything recently; I have been busy with other projects. While the production of NFTs has continued, other things took place. I have some art that I can describe as "not cutting it". These pieces will go into other areas where they find a use. For instance, some of my unreleased NFTs will go into wall art. I am currently working on some wall art to be released very soon. Another example is artwork for tote bags and slippers. I have a variety of good art for that. One can believe that this will help expand the brand into other areas, not just the NFTs. I was pleasantly surprised that I have some art that would be good for skinny tumblers, mouse pads, phone cases, and much more. I must confess I never thought of this area as an opportunity. Many products will be print-on-demand (POD). I am excited by this new avenue, with most of my time dedicated to this new direction. In some ways I am angry for not taking up this avenue sooner. Better late than never, I hear you say.

0 Comments

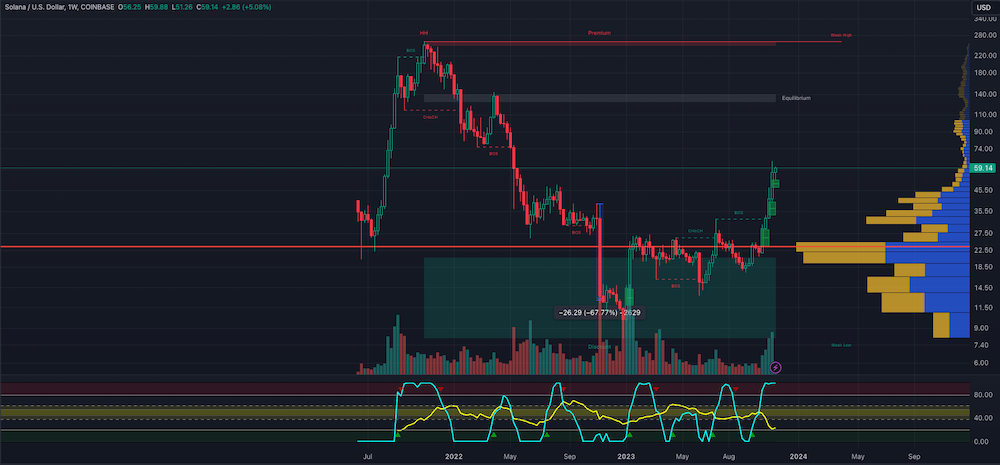

I am a big fan of Solana. As an asset, it has been very good to me both speculatively and long-term. As you all know, I am a big fan of NFTs. All NFTs of mine sold were through Solana. You may now understand my love for this asset. I confess recent price moves were more than welcome. Nevertheless, the cost of minting an NFT has risen - something unwelcome! Those using ETH certainly understand this sentiment! Solana has been a tear in recent weeks and went on to surpass USDC. It is now the sixth-largest cryptocurrency by market capitalisation. Over the last thirty days, we have seen a price rise of 162.1%. In addition, we have seen a 36% price rise over seven days. Two days ago, the price dropped to $51.54 but has since recovered to $59.15 at the time of writing. So, are we to expect another storm? Let us look at the charts. The daily chart shows a strong trend to the upside. There is also a price equilibrium between $39 and $42. This price range may act as support if there is any sudden fall in price. The volume profile indicates that with good momentum, there is nothing to stop the price from rising above the $63 range. One can easily question this as market energy is low at 25. I suppose we will have to wait and see what price action does. The weekly chart paints a similar picture, but being the higher timeframe with even lower energy at 22 causes some concern. We may yet see the price fall, but as mentioned, the $39 - $42 range may act as support. We all know that even when the charts say one thing, people's emotions can create an unrealistic asset price. Solana is in danger of just that. The question remains - is there another storm on the way? Maybe. No one knows. Conditions for another run upwards are present. As for if and when it will happen, your guess is as good as mine.

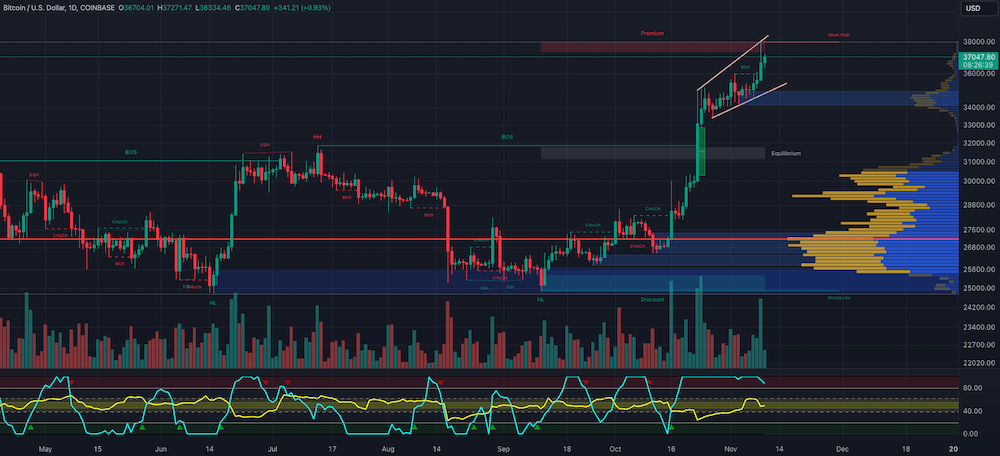

For full disclosure purposes, I am long on BTC! Ok, people, I have said it, so now you know. I am sure that most of you are watching the BTC price closely. For some, they found themselves on the outside looking in. I give no financial advice; I am not qualified. For those looking, wait till there is a retracement. We do, however, have a problem with this thesis. The BTC chart shows an ascending broadening wedge. An ascending broadening wedge, according to excellenceassured.com, is as follows: Price makes a low and rises. We then track price as it rises away from the low. We are looking for higher highs and higher lows in a tight range. The ascending says just one thing - the price will continue in its current direction, up. There is also an area of institutional selling, which doubles as a weak high. I have said in an earlier post that I expect the BTC price to hit $38k. It did so by hitting $37999! One expects Bitcoin to achieve that price point. At the mo, BTC is just over $37k, and the Choppiness Index shows there is still enough market energy to move the market upwards. Perhaps when it hits that point, a retracement will occur. No one can tell. Let me add this final point: energy on the weekly chart shows a decline. The Choppiness Index reads a value of just over 35. Market energy at this level might be just enough to ensure the $38k price point. As always, we are making educated guesses. Those late to the party pray for a retracement, and as to when it will arrive, your guess is as good as mine.

Let me be honest; I cannot sit down to do the intensive research which this subject requires. I must confess I find the whole thing vomitous. I plead guilty for not paying enough attention to recent machinations. We have all heard of the World Economic Forum (WEF) and what it's about. And I vaguely remember hearing suggestions of having people consume insects for protein instead of meat and poultry. I was dismissive and gave it no thought. There are even videos of celebrities - Nicole Kidman - eating bugs. Like me, you may have put this down to a stunt for likes on social media. We've heard all that I hear you say, but do you know what is happening now? For what must have been a very brief moment, I read with horror about one of Tyson Foods' latest moves. So, what was the move? Tyson Foods, a few weeks ago, took a minority stake in a start-up company named Protix. Who is Tyson Foods? Tyson Foods, Inc. is an American multinational corporation based in Springdale, Arkansas, that operates in the food industry. The company is the world's second-largest processor and marketer of chicken, beef, and pork after JBS S.A. So, who is Protix? Protix is a multinational manufacturer and supplier of insect ingredients for animal feed and human consumption. The company operates the world's largest insect factory, located in Bergen op Zoom in the Netherlands. Here is how Protix introduces itself on its website: Protix is the world leader in insect ingredients. We believe that feeding the growing world population should go hand in hand with protecting our beautiful planet. A huge challenge! Fortunately, the solution lies in nature itself: insects provide low-footprint proteins and other nutrients that can be processed into more sustainable feed and food. For those who thought this nightmare and madness was a joke, think again! For those who thought this nightmare and madness was a joke, think again! This is now beyond an Orwellian nightmare! Tyson Foods is quite serious about this. Their intentions are to “upcycle food manufacturing byproducts into high-quality insect proteins and lipids.” This means the normalisation of bug consumption, which includes placing bugs into pet food, aquaculture and livestock production. We are no longer in the realms of conspiracy theories but conspiracy facts. The introduction of stuff like this starts gradually and then becomes mandatory over a period of time. Only we can stop this madness because if we do not, we will suffer the consequences. As to how far these lunatics will go, your guess is as good as mine.

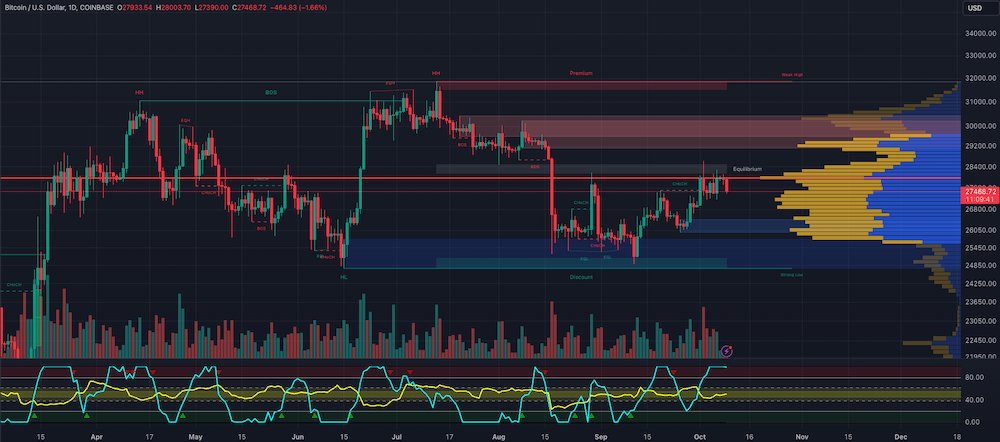

I wrote a blog yesterday with the Directional Movement Index (DMI) as the focal point. I did not publish it for all to see. Reasonable it may be, convincing it was not! I returned to using the indicators I always use - Laguerre RSI, Choppinex Index and the Volume Profile. So, here is my short and sweet analysis. Let us start with the weekly. The current BTC price is almost at the point of equilibrium. What this means is that there is an equal amount of buyers and sellers. Here, we have price levels of between $35.5k and $38k. The BTC price has tested the $35k level several times and will eventually break through. Should the breakthrough come, we will have BTC rising almost unimpeded to $38k. At this level, the Laguerre RSI and Choppiness Index have the strength to ensure this. Who knows, maybe the price will hit the $47k mark as long as there is strength in market energy (choppiness index). We now turn our attention to the lower time frame of one day. Here, we see strength in both the Laguerre and the Choppiness. The Choppiness is reconstituting strength, which will help further market momentum. Some analysts have posited a fall in BTC price levels. One may believe this to happen sooner than later because BTC is at an institutional selling price level, as you can see on the charts. At worst, I think BTC may fall to around $30k. Only something dramatic can bring it down to $25k levels. There will be retracement at some levels, but not the falls analysts are expecting. The uncertainty in the markets at the moment is causing all to be confused with the overall direction. Technical analysts among us will continue to look to the charts for answers. Others will lean on fundamental analysis. Some may even look to the stars for answers. Nevertheless, whatever you may have found or guided you, your guess is as good as mine.

Barring living under a rock, you will know of the Israeli-Palestinian conflict. The Israeli-Palestinian troubles saturate the news at the moment. I happen to be an individual who doesn't spend time watching TV. Nevertheless, I remember the saying, "Never let a good crisis go to waste". Unfortunately, the Israeli-Palestinian matter is one of those times. For those who love documentaries, you may have heard of Planet Finance. "Planet Finance" is a documentary that investigates and explains the ever-changing monetary system and its impact on both national and international levels. One point from the documentary is that traders are neither sensitive nor sentimental when money is to be made in a crisis - a constant theme throughout the documentary. You will get to hear this from the horse's mouth. The current situation is no different. After everything said, it begs the question, did prominent people know of the impending situation and say nothing? Did they intend to profit from the chaos? I have no proof such a thing happened, nor am I saying this is the case. Remembering the sentiment in the documentary, I decided to check out some of the defence contractors on my trading platform. Looking at the charts, I noticed a lot of bullish-engulfing in several of these stocks. A Bullish Engulfing Pattern is a technical analysis pattern that signals a potential reversal from a downtrend to an uptrend. It consists of two candlesticks: a small bearish (red or black) candlestick and a larger bullish (green or white) candlestick that engulfs or covers the entire body of the previous candlestick. This pattern indicates that buying pressure has overcome selling pressure and suggests that the market trend is changing from a downtrend (bearish) to an uptrend (bullish). Perhaps the most important here is that this engulfing pattern was on the 6th of October. Here are a few examples: We all know the attack took place on the 7th of October. And, of course, defence contractor share prices went up quite a bit on the 9th of October. Is it possible some knew and took a position to profit? In hindsight, I wish I had kept a tweet I read on my timeline. It asked a similar question. While I have no proof, it would not surprise me that some profited handsomely. You may look at the charts and say prices have fallen, no big deal. Maybe. But I promise you, placing a well-timed option will bring immense profits. While I have no proof of such trades occurring, my mind boggles. I cannot prove nor am I trying to. There are no conspiracy theories here. All we have are observations. And as for whether they are accurate, your guess is as good as mine.

Before discussing today's topic, let me refer you to a post I put out on the 9th of October titled, "BTC: Is There Too Much Excitement?" I stated that if BTC hit the $30500 price (a move of 8%), we could be on for a bull run. Ladies and gentlemen, we have hit that price level. There is the question of what's next. Let's have a look at the charts. On the daily chart, we see that the Laguerre RSI indicating BTC is overbought. There is also the fact that the flattening of the Laguerre RSI shows a continuous price rise. The Choppiness Index shows a drop in energy to 38, which means the price may begin to fall. I think the Choppiness Index will begin to consolidate for prices to continue to rise. I also suspect that the price will hit $32k before seeing a retracement. The reason for this is that we have a weak high at this level. On the weekly, the signs are more encouraging. The Laguerre RSI shows an upward momentum and is not in the overbought region. There is also strength in the Choppiness Index - meaning there is plenty of market energy. Judging by the volume profile, we expect BTC to hit $35k. Some analysts are now warning of the price action in the S&P 500. They posit two things. One, the S&P 500 is now below its 21-weekly moving average. Two, the S&P 500 price is also below the trend line. They believe that we must be concerned with this development. It means that these two signs indicate a fall in the overall market and the price of BTC. It will be interesting to see what happens as time goes on. As analysts, we can only posit based on experience, but no one can tell you what will happen. When we forecast, we hope it is in the right direction. Other than that, your guess is as good as mine.

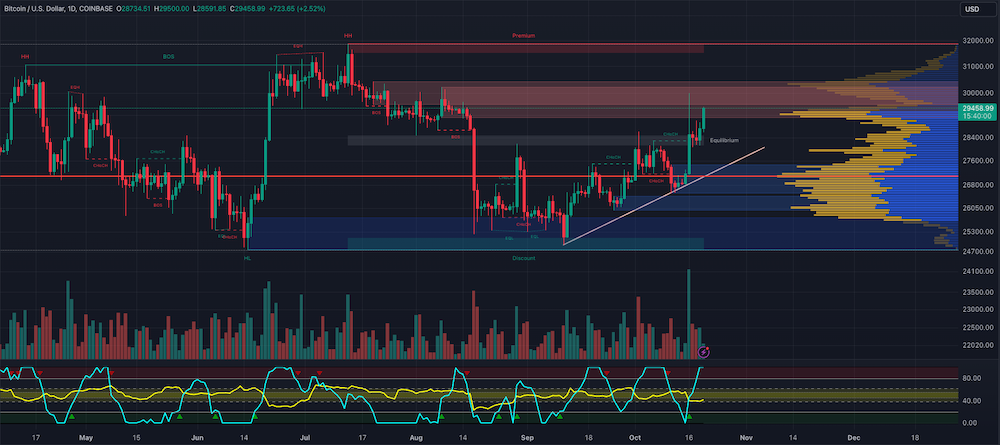

You may have taken your eyes off the ball when Bitcoin blasted its way to US$30k. In other words, you were busy with other matters. I was one of such people. On the evening of Monday the 16th, I got my first chance that day to look at the charts. To my surprise, I see the BTC price at US30k. I did wonder what brought this about. As I looked into it, reports surfaced that the approval of a BTC ETF (Exchange Traded Fund) is imminent. These reports were false and rumours. In the world of crypto, a day is a very long time. These rumours now have some validity. The SEC's (US Securities and Exchange Commission) recent losses in court have contributed to the excitement that there will be a BTC ETF before the end of the year. Institutional players, including BlackRock and Cathie Wood's ARK, are clamouring for this. It seems the tide has turned. A look at the charts tells us a lot. First, a new series of higher highs and higher lows indicates increased activity in the market. Second, the price broke through a confluence of institutional selling at price points between $29k and $30.2k. Many analysts believe $35k is possible. Some have gone as far as $40k. Finally, the series of higher highs and higher lows emanate from areas of institutional buying. The Laguerre RSI at 100 indicates that BTC is overbought. While the Choppiness Index has barely enough energy for a price push. These indicators tell us that prices may fall. Nevertheless, with the rumours swirling around, investors may be too enthusiastic to have a correction. So, do rumours conquer all? Sometimes, I guess. And as for the optimistic bets of $40k BTC, your guess is as good as mine.

The idea of crowd-sourcing modelling predates AI/Financial prediction firms. In addition, the concept of using models to predict financial prices or market direction came into play. What was missing was putting the two together. Perhaps the Achilles heel of this problem was data. Data was the glue to combine the two variables. No one with a good dataset would share it with the world as this was proprietary. Data is proprietary because it is difficult and expensive to gather and make useful for production. Without the ability to share proprietary data, there could be no crowd-sourcing. The solution to this problem was the encryption of data. While this was the right solution, another problem emerged. Encryption renders the data unusable; in other words, data loses all predictive structure. Solving the puzzle of keeping the predictive nature of data was the final key. The development of new encryption algorithms helped solve the problem of usability. By solving this problem, finance firms were free to crowd-source their predictions. Data encryption also solved the issue of bias. If data scientists knew what stock they were predicting for, their bias could lead to overfitting of data, hence the production of poor models. With this issue solved, the untapped programming and data science talent could now access excellent production-ready data. We now come to CrunchDao. While other firms are offering similar services, CrunchDaos’ offering is unique. It is not a hedge fund but a platform that powers financial institutions like hedge funds. With this, CrunchDao can aggregate different hedge funds, which creates more revenue streams and a robust business. It powers financial institutions via alpha signals its army of data scientists generates. So, what makes CrunchDao the best quant/ml competition? First, it is a pure DAO. DAOs ensure that every decision receives consent from all members. Any member can submit a proposal for improvements or changes to any matter of concern. Members then vote on the proposal. If they approve, it goes through; if not, put aside. You are certainly not going to get this in a hedge fund. And by the way, its data scientists are called "Crunchers". In addition, CrunchDao is open to all; anyone can join. Secondly, and perhaps most importantly, the quality of data. CrunchDao has made very clean and well-prepared data for immediate use. As mentioned, a data scientist may use the data immediately or perform exploratory analysis. Gathering data is expensive, but CrunchDao did not spare that expense. Thirdly, the competition objectives are clear: generate alpha and sell the signals. Having a clear direction means that CrunchDao can now have as many competitions as possible. At the moment, CrunchDao only develops alpha for stocks. CrunchDao can have alpha development for commodities, cryptocurrencies, and derivatives. The options are endless, meaning CrunchDao is agnostic in terms of assets. Fourth, we talked about compensation, but needs another look. There is also the flexibility of distribution in payment. Crunchers receive payment via the Dao structure in a token known as Crunch. The more competitions there are - the more compensation for the Crunchers. However, there is a contest - ADIA Labs -, which will pay in United States dollars. In addition, CrunchDao is looking at matters of internships, jobs, and other ways to recognise achievement. Fifth, we come to the matter of learning resources. The community meets on Discord, where ideas are expressed and shared. There are also papers, articles, and book titles on quant finance, machine learning and more. CrunchDao is also a very active participant in the new community of Decentralised Science (DeSci). DeSci is a movement that aims to use blockchain technology to make scientific research more open, transparent, and accessible. CrunchDao has created an environment for all participants of its competitions to submit research proposals and share research. It is worth noting that while DeSci holds promise, this is an emerging concept, and its widespread adoption is ongoing. No other organisation is providing this level of excitement and development. And there is more to come. We all know we are competing in a weekly tournament, but it does not feel like a tournament. Borrowing the word co-opetition feels more appropriate. One can only give the utmost respect to the men and women of CrunchDao - the crunchers - as they code for alpha. With that said, there is one message for all crunchers - "May thy code crunch and shatter. Long live the crunchers!" If interested in being part of this competition, please see here for details: https://nosax.me/crunchDao

There has been a lot of excitement about the BTC price movement. We have had the punditry come out with all sorts of predictions. It is no surprise to anyone; it is what we should expect. Is there room for excitement? Perhaps! Let us look at the evidence. Let's start with the charts. First, the BTC daily chart reveals that the point of control (PoC) acts as resistance. In addition, we are at an equilibrium point. Equilibrium is the state of the market where demand and supply are in balance with the price, indicating that the market price is at fair value. For the price of BTC to rise, it needs to break through not just the PoC but the equilibrium. Above both the equilibrium and the PoC, we have a large area of institutional selling (maroon in colour). We may see this area act as resistance. Institutional selling is $29140, a 3.91% move to the upside from the PoC. BTC has moved higher in the past; nevertheless, equilibrium needs consideration. Third and finally, the Laguerre RSI value. Currently, the Laguerre RSI has a reading of 100. The Laguerre RSI may remain at this value for a while but eventually fall. A value of 100 means BTC is overbought at current levels. For the excitement to be palpable, we will need BTC to hit the $30500 level, a move of over 8%. When BTC breaks that price, I believe we will have a great bull run. So, when will this happen? I know not. If you do, then your guess is as good as mine. To be part of this competition, please see here for details: https://nosax.me/crunchDao

|

Swap your cryptos here:

Nosa Capital

Nosa Capital concentrates its' expertise in Strategy, Business Development, Project Management, Project Finance, Trending, and now cryptocurrencies Archives

November 2023

Categories

All

|

Photos from QuoteInspector, wuestenigel, Hektorej, SimpleFX, verchmarco, barbourians, Bestpicko, Noam A., verchmarco, verchmarco, wuestenigel, wuestenigel (CC BY 2.0), Casinolobby.dk, mr.ddenisov, focusonmore.com (CC BY 2.0), PerfectHue, b_d_solis, davidstewartgets, wuestenigel, afiler, wuestenigel, verchmarco, SimpleFX, nodstrum, wuestenigel, verchmarco (CC BY 2.0), wuestenigel, sirqitous, TheAlieness GiselaGiardino²³, QuoteInspector, wuestenigel, marcoverch, Jorge Franganillo, verchmarco, wuestenigel, wuestenigel, wuestenigel, wuestenigel, Jorge Franganillo, wuestenigel, TLC-kios, SimpleFX, SimpleFX, wuestenigel, wuestenigel, wuestenigel, wuestenigel, verchmarco, wuestenigel, Infosec Images, ttmarketing, Toolstotal, SimpleFX, wuestenigel, marcoverch, wuestenigel, focusonmore.com, Cryptodost, zcopley, btckeychain, Crypto360, QuoteInspector, wuestenigel, davidstewartgets, trendingtopics, Raisin - Finance Stock Images, wuestenigel, stockcatalog, verchmarco, focusonmore.com, wuestenigel, TwinPeaks99, orgalpari, marcoverch, orgalpari, arne-mueseler.com, orgalpari, Bestpicko, Jim Makos, wuestenigel, jane.boyko, Infosec Images, verchmarco, SimpleFX, stockcatalog, Bestpicko, mikemacmarketing, wuestenigel

RSS Feed

RSS Feed